FAQS

Operational advice for dealers, workshops and other related businesses

ENGLAND From 22 February – 29 March 2021: The position for dealerships with customers’ caravans and motorhomes already on their premises undergoing servicing or repair has not changed. This work can continue as those who are unable to work from home are permitted to travel to work or for work purposes. Dealer members must ensure that their workshops are COVID compliant with the necessary spacing and hygiene provisions in place, and access for the public is prohibited. The stay-at-home rule remains in place and a customer taking a leisure vehicle to a workshop for service or repair is currently regarded as non-essential travel, so would be in breach of the Regulations.

SCOTLAND From 23 February – 5 April: The position remains the same and has not changed. The ‘stay- at home’ rule remains in place until 5 April at the earliest. See above for England.

WALES From 22 February: the position remains the same and has not changed. The ‘stay-at home’ rule remains in place but will be reviewed on 12 March. See above as for England.

ENGLAND

From 29 March 2021: From this date the Westminster Government’s intention is for the ‘stay at home’ law to be lifted but travel should be kept to a ‘minimum’. Providing the four tests are met – see below – this can be interpreted to mean that, providing your customers are ‘local’ and providing they contact you in advance to make a firm booking, and there is NO PUBLIC ACCESS to your workshop or dealership, they can collect their vehicle once ready OR arrange to deliver their vehicle for service/repair. For customers who are not ‘local’ you can continue to offer a home delivery service to the customer’s home address. Do check your insurance policy so you are covered for such journeys which would be deemed a commercial movement. It is important that you and your workforce follow the suggested procedures – see here – and ensure that documentary evidence is carried by the driver, in case your vehicle is stopped on the journey.

From 12 April 2021 – at the earliest: From this date – providing the four tests are met (the vaccine deployment continues successfully, hospitalisations and deaths are reduced, infection rates do not increase, and the risks are not changed by new COVID variants) – non-essential retail will reopen. This includes leisure vehicle showrooms /dealerships and workshops.

SCOTLAND

From 5 April 2021 at the earliest: Following the First Minister’s announcement on 23 February Scotland’s lockdown will be eased in three stages over the next two months with the three stages separated by at least 3 weeks. The Scottish government will announce more details in mid-March, but it is hoped that the current stay-at-home order will be lifted along with the resumption of the click and collect services on 5 April. This can be interpreted to mean that providing your customer contacts you in advance to make a firm booking and there is NO PUBLIC ACCESS to your workshop or dealership, they can collect their vehicle once ready OR arrange to deliver their vehicle to you for service/repair.

From 26 April at the earliest: If the criteria governing the system of ‘levels’ is met it is anticipated that the country will move to Level 3, and non-essential retail such as dealerships will reopen. COVID-secure guidelines will remain in place – social distancing, face coverings and hand sanitising in all areas of the business.

WALES From 22 February: the position remains the same and has not changed. The ‘stay-at home’ rule remains in place but will be reviewed on 12 March. See above as for England.

ENGLAND

From 29 March: There will be a great demand from existing customers wishing to book their caravan or motorhome in for servicing or repair ahead of the opportunity to ‘get back out on the road’ and visit holiday parks and campsites. It is also important that customers can ensure that their vehicles remain safe and roadworthy before they venture out for spring and summer. Subject to the COVID-complaint capacity in your workshop, you can now offer pre-booked servicing and repair appointments where customers can deliver and collect their own vehicles from this date on – 29 March. Please note that workshops and retail dealerships/showrooms will still remain closed by law. You must ensure that the premises remain closed to customers and adhere to COVID-secure guidelines (social distancing, hygiene and face masks) when dealing with collection and delivery from customers.

From 12 April at the earliest: From this date (subject to the 4 tests) non-essential retail will reopen. This includes leisure vehicle showrooms /dealerships and workshops

SCOTLAND

5 April at the earliest: There will be a great demand from existing customers wishing to book their caravan or motorhome in for servicing or repair ahead of the opportunity to ‘get back out on the road’ and visit holiday parks and campsites when they reopen. It is also important that customers can ensure that their vehicles remain safe and roadworthy before they venture out for spring and summer. Subject to the COVID-complaint capacity in your workshop, you can offer pre-booked servicing and repair appointments where customers can deliver and collect their own vehicles no earlier than 5 April. Please note that workshops and retail dealerships/showrooms will still remain closed by law. You must ensure that the premises remain closed to customers and adhere to COVID-secure guidelines (social distancing, hygiene and face masks) when dealing with collection and delivery from customers.

WALES

From 22 February: The position remains the same and has not changed. The ‘stay-at home’ rule remains in place but will be reviewed on 12 March. See above as for England.

ENGLAND

From 22 February – 21 June: The position regarding the transportation of goods between business premises has not changed and can continue providing that COVID secure guidelines are followed, that drivers can evidence the purpose of their journey, and carry relevant documentation.

From 21 June: Government anticipates – providing that the 4 tests continue to be met – that legal limits on social contact are lifted.

SCOTLAND

It is understood that the position regarding the transportation of goods between business premises has not changed and can continue, providing that COVID secure guidelines are followed, that drivers can evidence the purpose of their journey, and carry relevant documentation.

WALES

It is understood that the position regarding the transportation of goods between business premises has not changed and can continue providing that COVID secure guidelines are followed, that drivers can evidence the purpose of their journey, and carry relevant documentation.

ENGLAND

Many dealerships been operating an online ‘browsing’ service to customers during lockdown. Orders for touring caravans or motorhomes placed last year are also now arriving from the manufacturers.

Collection of pre-ordered new vehicles

There will be a great demand from existing customers wishing to collect their new caravan or motorhome ordered last year. Leisure vehicle dealerships and showrooms remain closed by law until 12 April at the earliest.

However, once the stay-at-home order is lifted on 29 March at the earliest, it is understood that customers can make an appointment to collect their new vehicle from your outside showground or forecourt only and providing that they are local and their journey is kept to a minimum.

You must ensure that the premises remain closed to customers and you adhere to strict COVID-secure guidelines (social distancing, hygiene and face masks) when dealing with the handover of the vehicle. You should also give consideration to a safe and secure handover procedure – which may include a ‘virtual tour’ of the vehicle in advance.

SCOTLAND

Leisure vehicle dealerships and showrooms remain closed by law until 26 April at the earliest.

However, once the stay-at-home order is lifted on 5 April at the earliest, it is understood that customers can make an appointment to collect their new vehicle from your outside showground or forecourt only and providing that they are local and their journey is kept to a minimum.

You must ensure that the premises remain closed to customers and you adhere to strict COVID-secure guidelines (social distancing, hygiene and face masks) when dealing with the handover of the vehicle. You should also give consideration to a safe and secure handover procedure – which may include a ‘virtual tour’ of the vehicle in advance.

WALES

From 22 February – the position remains the same and has not changed. The ‘stay-at home’ rule remains in place but will be reviewed on 12 March. See above as for England.

ENGLAND, SCOTLAND, WALES

It is understood that commercial deliveries for certain businesses can continue including receiving new season stock from manufacturers in preparation for reopening. It is crucial that deliveries follow the suggested COVID- secure processes and procedures.

ENGLAND

For customers who have made an expression of interest in purchasing a new vehicle – caravan or motorhome – access to non-essential retail premises (leisure vehicle dealerships and showrooms) remain closed to the public until 12 April at the earliest.

From this date it is suggested that customers are offered a timed appointment when access to vehicles and deposits etc can be made in person. It is essential that COVID-secure guidelines are followed in full including social distancing, face-coverings and hand sanitising arrangements.

SCOTLAND

For customers who have made an expression of interest in purchasing a new vehicle – caravan or motorhome – access to non-essential retail premises (leisure vehicle dealerships and showrooms) remain closed to the public until 26 April at the earliest.

From this date it is suggested that customers are offered a timed appointment when access to vehicles and deposits etc can be made in person. It is essential that COVID-secure guidelines are followed in full including social distancing, face-coverings and hand sanitising arrangements.

WALES

From 22 February – the position remains the same and has not changed. The ‘stay-at home’ rule remains in place but will be reviewed on 12 March.

Coronavirus Job Retention Scheme (CJRS): first scheme

The Government announced the introduction of a temporary job retention scheme, open to all UK employers for at least 3 months, starting from 1st March 2020. The objectives are simple. 1) It is to keep as many workers as possible employed (albeit on a reduced wage). 2) Avoid large numbers of people defaulting on rent and/or mortgages. 3) Assisting companies to maintain their skilled workforce ready for when the current crises ends and their skills are needed. 4) Assist with the social distancing regulations.

Any UK employer can potentially claim. The claim can be backdated until 1st March 2020. The employer can also claim if they made employees redundant since 28th February 2020. There are some caveats, specifically around Public Sector Organisations where the Government already funds the wages.

- The limit is the lower of £2,500 or 80% of the furloughed employees’ wages.

- The employer must have had a payroll scheme in operation by 28th February 2020.

- The employer must have a UK bank account.

- The employee cannot carry out any duties for the employer while on furlough.

- The employer needs to write to the staff advising them that they are being furloughed. The normal employment regulations in terms of record keeping apply.

- Employees hired after 28th February 2020 are not eligible for furloughing.

- Employees must be furloughed for a minimum of 3 weeks and for up to 3 months (although this may be extended) from 1st March 2020.

- Employees who are on sick leave or self-isolating cannot be furloughed but may be furloughed once they come back to work. Statutory Sick Pay applies whilst they are on sick leave or self-isolation and the government have made temporary changes to this throughout the coronavirus crisis.

- Employees shielding from the virus in line with public health guidance can be furloughed.

- Available for full-time, part-time, agency, flexible and zero-hour contracted employees.

- Whilst on furlough the employees wage will still be subject to tax and other deductions.

Those employees on reduced hours or reduced pay will not be eligible for this scheme and employers will have to continue paying their salary subject to the terms of the employment contract agreed. Employers should discuss with their staff and make any changes to the employment contract by agreement. When employers make the decision in relation to the process, including who to offer furlough to, equality and discrimination laws will apply in the usual way.

Employers can furlough any employee who has been subject to PAYE, including directors. Where directors are using dividends to top up their income, these amounts are unlikely to form part of the CJRS calculation as dividends are not subject to PAYE.

This scheme will include an allowance for the 3% minimum employer Auto-Enrolment contributions as well as Employer NI liabilities for salaries up to £2,500 a month (these will be based on the lower furlough wage). Employers paying above the minimum contribution will not be able to claim back this additional contribution above the 3%. Employers can not stop their pensions scheme during lockdown. Employees will be expected to continue to pay their minimum contribution. Whilst they can opt out, this would mean that they lose valuable employer contributions. What happens to salary sacrifice schemes? Where furloughed staff are participants in a salary sacrifice scheme, unless the employees contractual terms are varied, the salary sacrifice is likely to continue from the furloughed pat and the benefits available to the employee are likely to continue. Current guidance does not specify refer to this. It may be possible to cancel the salary sacrifice and associated provision of a benefit as part of a contractual variation. As with all contractual variations, this should be discussed and agreed with the employee and if necessary, employment law advice taken by the business.

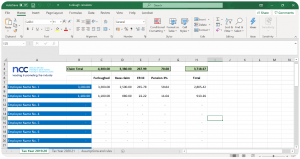

The calculator is designed to assist our members with calculating the cost of furloughing staff instead of laying them off. There are cashflow implications for doing this as HMRC have stated that the online portal will not be active until late April 2020. Your business is therefore funding the furloughed staff for a minimum of 2 months if you are able to backdate the scheme to 1st March 2020. There are other options available from the Government to assist with the above identified short-time cashflow issue, mainly loans available from your bank, and these will be covered off under a separate document. The calculator has both tax years included, to allow for changes in current and next tax year.  Click here to download The password is ncc-furlough.

Click here to download The password is ncc-furlough.

HMRC have currently not released some of the finer details, specifically around Employers Ni and Employers pensions. The calculations are based on the tax year 2019/20. An updated schedule will also be available. Notwithstanding the above, the calculations are fairly straight forward. We have used 2 examples to demonstrate how the calculations work. An employee earning £1,100 per month and an employee earning £3,200 per month. 1. Employee earning £1,100 per month: a. Calculate the Base claim. In this case it is 80% of the gross wage, being £880. b. Calculate the Employers Ni. On current rules and assuming no change to the 0% threshold, the total is ((£880 – £719) * 13.8%) = £22.22. c. Calculate the minimum pension contribution. On current rules and assuming no change to the minimum threshold, the total is ((£880 – £512)* 3%) = £11.04. d. Calculate the total. The total claim under current rules is £880.00 + £22.22 + £11.04 = £913.26. 2. Employee earning £3,200 per month: a. Calculate the Base claim. In this case it is capped at £2,500. (£3,200 * 80% = £2,560). b. Calculate the Employers Ni. On current rules and assuming no change to the 0% threshold, the total is ((£2,500 – £719) * 13.8%) = £245.78. c. Calculate the minimum pension contribution. On current rules and assuming no change to the minimum threshold, the total is ((£2,500 – £511)* 3%) = £59.64. d. Calculate the total. The total claim under current rules is £2,500 + £245.78 + £59.64 = £2,805.42. 3. The figures above change slightly in April and May 2020 with the updated thresholds to £903.18 and £2,795.34 respectively. 4. Please note that the claim is reduced in 2021 because there is an increase in the 0% employers Ni threshold, thereby reducing the amount paid.

Disclaimer

This document is for general guidance only.

Any decision on furloughing staff is a business decision and should be taken in conjunction with your normal legal and professional and financial advisors.